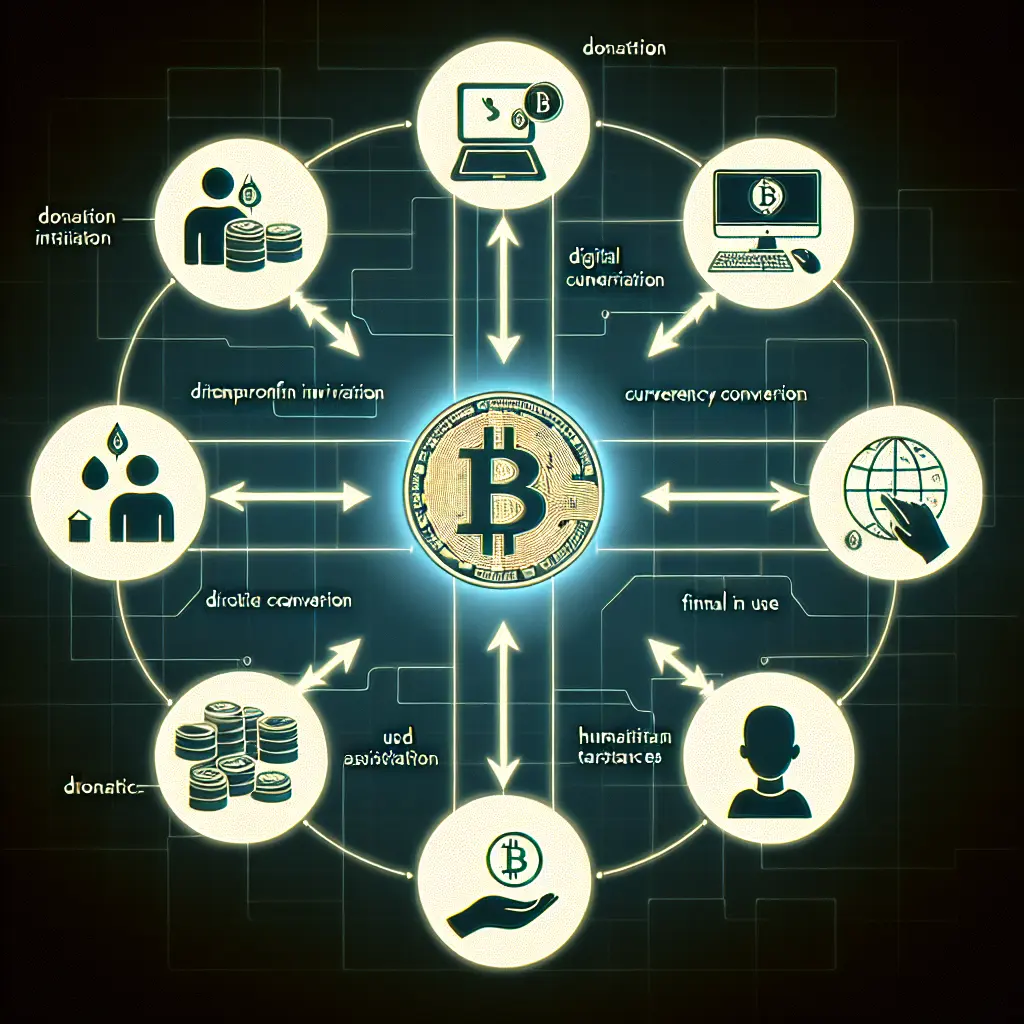

The advent of Bitcoin and its underlying blockchain technology has dramatically transformed various sectors, and the non-profit world is no exception. The potential for Bitcoin to streamline donations is immense, offering efficiency, transparency, and a host of other benefits that could significantly enhance how charities operate. This blog post delves into the transformative role of Bitcoin in non-profit donations, illustrating how cryptocurrency can empower both charities and donors.

The Efficiency of Bitcoin in Non-Profit Donations

One of the most compelling advantages of using Bitcoin for charity is the ability to streamline donations. Traditional donation methods often involve multiple intermediaries, currency exchange fees, and processing delays. Bitcoin non-profit donations, however, offer a direct channel between donor and recipient. This directness not only reduces overhead costs but also speeds up the transfer process, ensuring that aid reaches its intended recipients swiftly. Platforms like BitPay and The Giving Block are making it easier for charities to accept Bitcoin, providing tools that integrate cryptocurrency donations seamlessly into their existing systems.

Enhanced Transparency and Accountability

The transparency inherent in blockchain technology, which underpins Bitcoin, means that every transaction is recorded on a public ledger. This feature is particularly beneficial for cryptocurrency in charities as it promotes greater accountability. Donors can see exactly where their contributions are going, and charities can provide indisputable proof of how funds are being used. This level of transparency is appealing to a generation of donors who increasingly demand accountability and tangible impacts from their contributions.

Tax Benefits and Incentives

For donors, the tax benefits of Bitcoin donations are significant. In many jurisdictions, Bitcoin charitable contributions can be deducted on taxes similar to traditional cash gifts. However, because Bitcoin is classified as property by the IRS, donors do not have to pay capital gains tax on the appreciated amount if the cryptocurrency has increased in value since they acquired it. This aspect not only benefits the donor but also encourages larger donations to non-profits.

Recent developments have further highlighted Bitcoin’s volatile yet influential role in the financial landscape. For instance, news of an assassination attempt on Donald Trump coincided with a surge in Bitcoin prices (source needed). Such events unpredictably influence market dynamics and could affect how non-profits manage their crypto donations.

Moreover, political figures like Donald Trump and RFK Jr. have expressed varying degrees of support for integrating Bitcoin into national strategies. Trump’s vision to make the U.S. a ‘Crypto Capital’ and RFK Jr.’s proposal for the government to purchase a substantial amount of Bitcoin (source needed) could reshape regulatory frameworks and potentially increase the adoption rate of cryptocurrencies in various sectors, including non-profits.

Bitcoin Donation Platforms

Using Bitcoin for Non-Profits: Real World Applications

Navigating the landscape of Bitcoin donation can be complex without the right tools. Platforms specifically designed for crypto donations non-profit sector like The Giving Block make it easier for charities to accept Bitcoin donations. These platforms not only handle the technical aspects of receiving cryptocurrencies but also help non-profits comply with regulatory requirements and provide them with tools to effectively track and utilize these donations.

Several non-profits have already embraced Bitcoin and experienced its benefits. For instance, organizations like Save the Children and United Way accept Bitcoin, allowing them to tap into a new demographic of donors who prefer using digital currencies. Moreover, the Jersey City Pension Fund's decision to invest in Bitcoin ETFs signifies growing trust in Bitcoin’s long-term value proposition (source needed).

Challenges and Considerations

Despite its benefits, using Bitcoin for non-profits comes with challenges. The volatile nature of Bitcoin means that its value can dramatically fluctuate, which can affect budgeting and financial planning for non-profits. Additionally, there is still a significant regulatory grey area around cryptocurrency in many countries, which can complicate acceptance and usage.

Bitcoin’s role in enhancing non-profit donations is becoming increasingly undeniable. From streamlining donation processes and reducing overhead costs to providing tax benefits and improving transparency, the advantages are clear. However, as with any innovation, there are hurdles to overcome. Non-profits considering Bitcoin donations should weigh the benefits against potential risks and keep abreast of regulatory changes.

Leave a Comment