Bitcoin's Role in Streamlining International Aid and Development Funds

In the evolving landscape of global finance, Bitcoin and other cryptocurrencies are becoming increasingly significant, especially in the realms of international aid and development funding. The unique properties of blockchain technology, which underpins these digital currencies, offer promising solutions to some of the perennial challenges faced by humanitarian efforts, including inefficiencies, corruption, and lack of transparency.

Cryptocurrency in Aid Distribution: A New Efficiency Paradigm

The use of cryptocurrency in aid distribution has been lauded for its efficiency and speed. Traditional methods of disbursing aid are often slow, with funds having to navigate through multiple channels, each introducing delays and potential for misappropriation. Bitcoin and other cryptocurrencies can drastically reduce transaction times from days to minutes, ensuring that aid reaches its intended recipients swiftly. This efficiency is not just theoretical; various NGOs and international aid organizations are already experimenting with Bitcoin to move funds across borders quickly and at a fraction of the cost of traditional banking methods.

Blockchain Technology: Ensuring Transparency and Reducing Corruption

Bitcoin Remittances and Global Development

One of the most compelling uses of blockchain technology in international aid is its ability to enhance transparency and accountability. Each transaction recorded on a blockchain provides a clear, immutable history that can be publicly verified, making it extremely difficult for funds to be diverted without detection. This feature addresses a critical challenge in humanitarian aid: corruption. For instance, blockchain solutions for development have been implemented in several pilot projects to track the disbursement of funds from donors directly to beneficiaries, effectively bypassing potentially corrupt intermediaries.

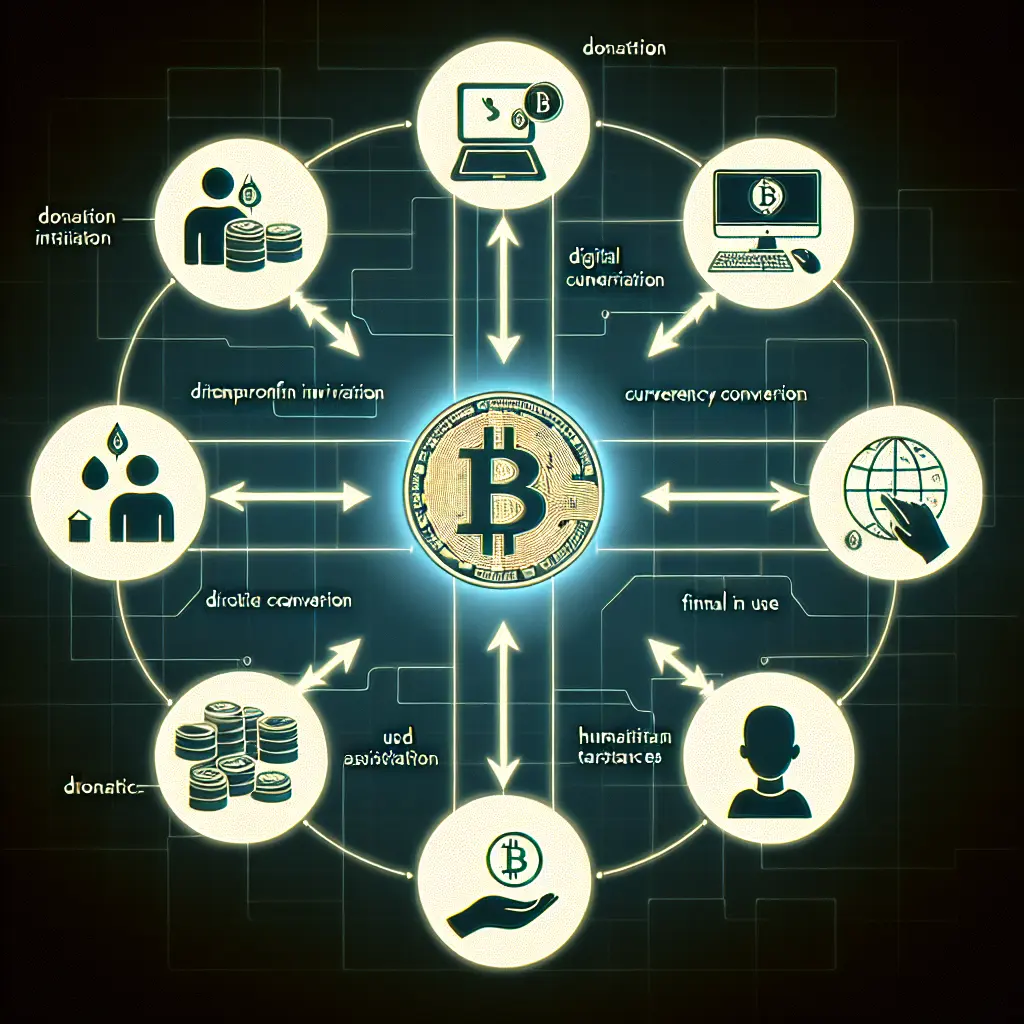

Remittances play a crucial role in the economies of many developing countries. With Bitcoin, individuals can send remittances without the hefty fees associated with traditional money transfer services. This has a direct impact on global development, as more money reaches the hands of those who need it most, potentially increasing their spending power and improving their living conditions.

Recent News Impacting Bitcoin's Role in International Aid

The landscape of cryptocurrency, particularly Bitcoin, is frequently shaped by global events and key personalities. Recently, Donald Trump's shifting stance on cryptocurrency has made headlines. Initially skeptical, Trump's recent promise to make the U.S. the "Crypto Capital of the Planet" and a "Bitcoin Superpower" could significantly influence global cryptocurrency markets and policies.

High-Profile Endorsements and Investigations

Moreover, incidents like the assassination attempt on Donald Trump have led to market fluctuations with Bitcoin experiencing a surge post-event. Such volatility is important for NGOs and governments to consider when adopting Bitcoin for aid purposes.

High-profile endorsements and legal investigations also play a role in shaping public perception and regulatory landscapes. Craig Wright, who claims to have created Bitcoin, is currently under investigation for perjury. These legal proceedings could impact Bitcoin’s credibility and its adoption for serious applications like international aid.

Local Impacts: From Texas to Jersey City

On a more localized level, developments such as the annexation of a gigantic Bitcoin mine by a tiny Texas village highlight the growing integration of cryptocurrency infrastructure into American communities. Meanwhile, Jersey City's decision to invest pension funds in Bitcoin ETFs signals growing institutional trust in Bitcoin’s long-term value.

Global Movements: RFK Jr. and U.S. Strategic Reserves

The Future of Crypto Donations and NGO Funding

Intriguing proposals such as RFK Jr.'s plan to direct the U.S. government to buy $615 billion in Bitcoin could dramatically alter the scale and scope of cryptocurrency use in national reserves. Similarly, plans to finance a strategic Bitcoin reserve by revaluing the Fed’s gold reserves highlight innovative approaches to integrating Bitcoin into national financial strategies.

The growing acceptance of Bitcoin in global charity circles is evident from initiatives like crypto donations for international aid. These allow donors from around the world to contribute securely and transparently. Moreover, as NGOs begin to recognize the potential of Bitcoin for funding, we may see an increase in its use not just for one-off donations but as a cornerstone of nonprofit financial strategies.

Concluding Thoughts

Bitcoin’s integration into international aid and development funds is not just a possibility; it is already underway. The technology offers transformative benefits in terms of efficiency, transparency, and corruption reduction. However, it also faces challenges including market volatility and regulatory uncertainties as evidenced by recent news events.

As we move forward, it will be crucial for policymakers, international organizations, and private sectors to collaborate on creating regulatory frameworks that harness these benefits while mitigating risks. For those of us watching this space, it remains an exciting time as we witness potentially one of the most significant shifts in how global aid is administered in modern history.

Leave a Comment