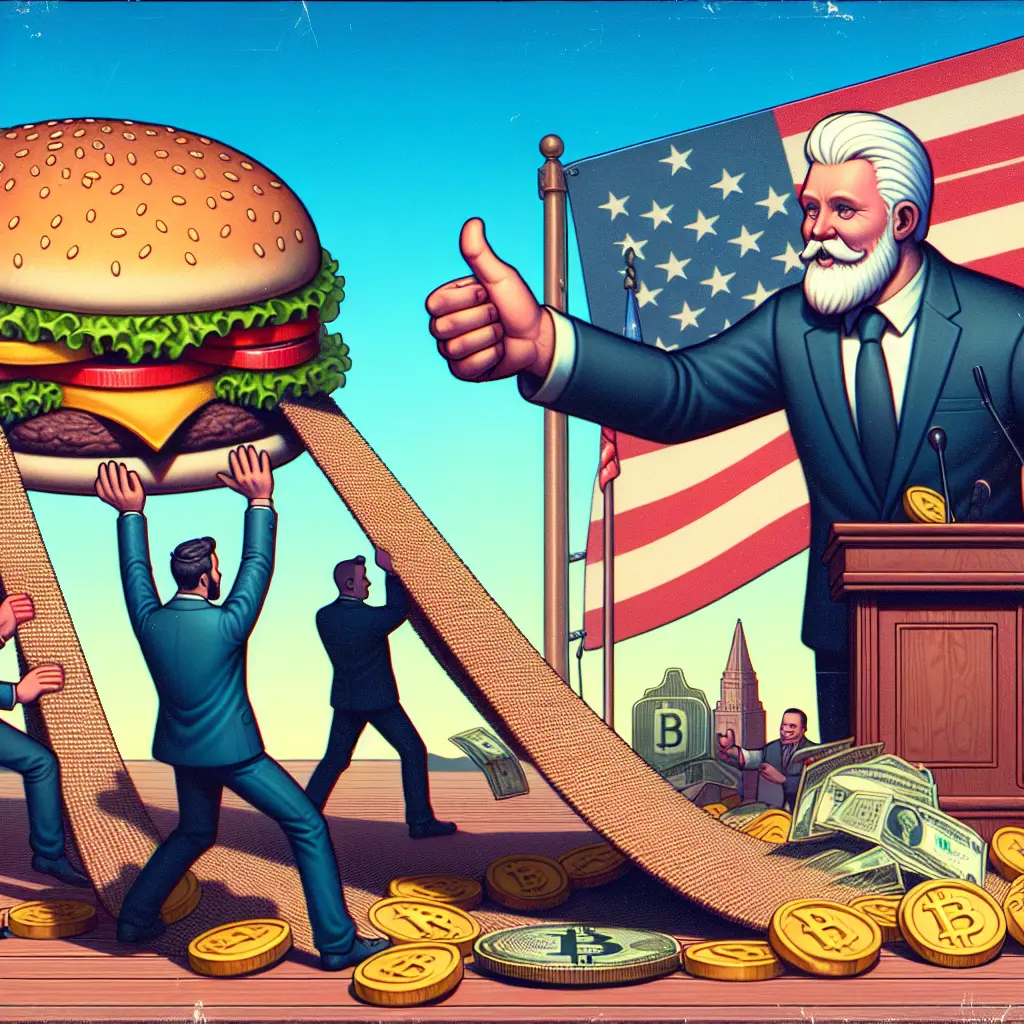

Michael Saylor is set to bring Bitcoin into the boardroom as he prepares to pitch a Bitcoin investment strategy to Microsoft's directors next month.

In a notable move for the cryptocurrency community, Michael Saylor, the founder of MicroStrategy and a well-known Bitcoin advocate, has announced his upcoming presentation to Microsoft's board of directors. This initiative could mark a significant step in integrating Bitcoin within major corporate strategies.

Who is Michael Saylor?

Michael Saylor has been a prominent figure in the Bitcoin space for years. As the founder of MicroStrategy, a company that made headlines for its substantial investments in Bitcoin, Saylor has often championed the cryptocurrency as a key asset for corporate treasuries. His advocacy has extended beyond just MicroStrategy's boardroom, influencing broader conversations about Bitcoin's role in the financial ecosystem.

Why Bitcoin for Microsoft?

The Upcoming Presentation

Microsoft, a leading technology giant, is no stranger to innovation and progressive strategies. By considering a Bitcoin investment strategy, Microsoft could enhance its financial diversification and hedge against inflationary pressures. The inclusion of Bitcoin in corporate portfolios offers:

Diversification: Bitcoin provides an alternative to traditional financial assets like stocks and bonds.

Inflation Hedge: As a decentralized currency with a capped supply, Bitcoin can act as a safeguard against currency devaluation.

Future-Proofing: As digital currencies gain traction, being ahead of the curve can position companies favorably.

The Potential Impact

Saylor's presentation is scheduled to take place next month. According to details shared during a VanEck-hosted event, Saylor will have a brief but potentially impactful three-minute window to make his case to Microsoft's directors. This concise format challenges Saylor to deliver a powerful and persuasive argument that encapsulates the benefits and strategic advantages of adopting Bitcoin.

Should Microsoft's board decide to act on Saylor's advice, it could trigger a ripple effect across other major corporations. Acceptance from such an influential company would likely bolster confidence in Bitcoin, potentially encouraging other firms to explore similar strategies. This could further solidify Bitcoin's position not just as an investment vehicle but as a crucial component of modern financial strategies.

The upcoming presentation by Michael Saylor represents more than just another pitch; it's a testament to Bitcoin's growing importance in corporate finance. If successful, this could pave the way for other companies to consider Bitcoin not just as an investment but as an integral part of their financial strategies.

For those interested in following this development, you can read more about the upcoming presentation here.

May your investments be as bold as Saylor’s vision for Bitcoin.

Leave a Comment